Health Insurance Company

Launching a health insurance company demands considerable effort, strategic planning, and commitment. This detailed guide offers a structured approach to help you begin your journey in the insurance industry.

Health insurance aims to assist individuals and families in managing the substantial expenses of medical care. Without such coverage, individuals would cover the total costs of healthcare and hospital bills themselves. Health insurance plans are among the most sought-after products in the industry.

Insurance Industry

For aspiring entrepreneurs, this represents a valuable chance to enter the insurance industry. However, launching your own health insurance company demands thorough planning and preparation.

To assist you on your path, Insurance Business provides a comprehensive guide for starting a health insurance company. Whether you are new to the industry exploring the market or an experienced professional aiming to establish your own business, this article offers valuable insights. Discover the key steps to building a successful health insurance company with this guide.

What does a health insurance company do?

A health insurance company focuses on offering clients various health plans that cover either part or all of their medical and hospital costs. The primary aim is to assist patients in managing the high expenses of healthcare and treatment.

Many health insurance companies function as small businesses, helping clients get affordable coverage through the health insurance marketplace.

Health Insurance Exchange

For newcomers to the field, the health insurance marketplace is a platform where many low-income Americans look for cost-effective healthcare options. This platform is also known as the health insurance exchange or simply the marketplace.

In most states, the federal government manages the marketplace through Healthcare, although some states run their exchanges. Individuals can use these platforms to compare and enrol in health plans that meet their needs and budget.

Clients have the option to find suitable coverage through call centres and in-person help.

Private health insurers also play a significant role, with some being prominent global brands.

These major health insurance providers typically have extensive networks of healthcare professionals and serve millions of clients. According to recent data, the top 10 largest health insurance companies in the US dominate nearly 60% of the market.

How do you start a health insurance company?

Similar to other insurance sectors, the appeal of starting a health insurance company lies in its significant growth potential. However, establishing your insurance firm demands extensive planning, effort, and commitment. This comprehensive guide to starting a health insurance company provides you with the direction you need to succeed.

Step 1: Prepare a solid business plan.

A robust business plan is essential for the success of your health insurance company. It will act as a roadmap, guiding you toward profitability and helping you identify crucial markets. A well-crafted business plan demonstrates your understanding of business operations, which can be instrumental in securing funding for your venture.

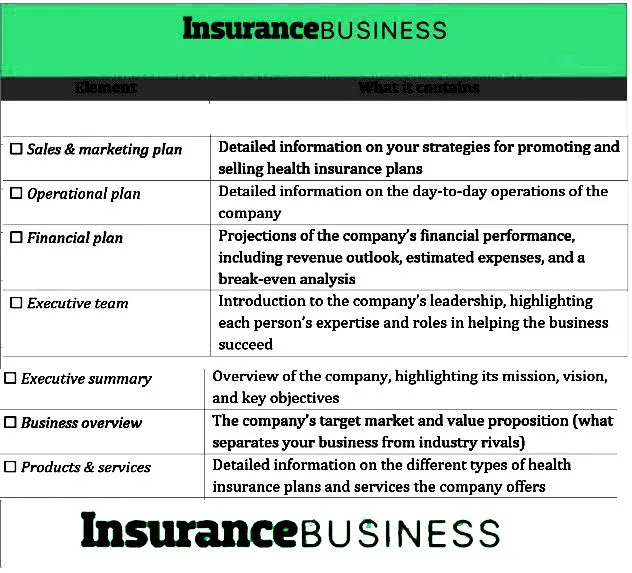

A thorough business plan includes various key components. This checklist from the Insurance Business outlines the essential elements you should incorporate into your plan. You can download and save this document for convenient reference.

Step 2: Determine which health insurance plans you will offer.

In 2010, the United States passed the Affordable Care Act (ACA), commonly referred to as Micro. This extensive reform law aims to lower healthcare costs for families and increase access to health insurance for more Americans.

The ACA provides a way for individuals who might be uninsured because of financial constraints or pre-existing conditions to get affordable coverage via the health insurance marketplace.

Through these exchanges, individuals can choose a health plan that best fits their specific needs and circumstances. These options include:

Readmore Insurance claims: Five tips on how to process your insurance how long it will take

Health Maintenance Organization (HMO)

In this plan, coverage is restricted to care provided by doctors who are employed by or have a contract with the HMO, except in emergencies. Some health plans might require policyholders to live or work within the designated service area to be eligible for coverage.

Exclusive Provider Organization (EPO)

This managed care plan offers coverage only for services provided by doctors, specialists, or hospitals within the plan’s network. Similar to HMO plans, these restrictions are waived in emergencies.

Point of Service (POS)

In this plan, policyholders incur lower costs by selecting doctors, hospitals, and other healthcare providers within the plan’s network. POS plans require policyholders to get a referral from their primary care physician before consulting a specialist.

Preferred Provider Organization (PPO)

In a PPO plan, policyholders benefit from lower costs when they receive care from providers within the plan’s network. They also have the option to visit doctors, hospitals, and other providers outside the network without needing a referral, although this will incur higher costs.

Discover the various health insurance plans and their advantages in this guide.

Step 3: Raise the necessary funding.

Launching your own health insurance company is a costly endeavour. Industry experts suggest that startup capital typically ranges from $50,000 to $500,000 or more, depending on the scale and structure of your business. The funds you secure will cover:

- Licensing requirements

- Business registration and permits

- Operational expenses, such as office space, equipment, staffing, and salaries

- Marketing and advertising expenses

- Insurance coverage

For more details on the costs involved in starting an insurance company, refer to this guide.

You can use your funds to finance the start-up costs of a health insurance company, such as personal savings. Alternatively, you might consider raising money by selling property or other assets.

If your resources are inadequate, there are additional methods for securing financing, including:

- Business Loan: This is a common method for raising capital for a startup. You can apply for a loan from banks and other lenders, but you’ll need a strong business plan and a solid credit history to secure approval.

- SBA-Guaranteed Loan: The Small Business Administration (SBA) can act as a guarantor, helping you get bank approval through an SBA-guaranteed loan.

- Government Grants: Financial help for new businesses is available through grants.gov, provided by the federal government.

- Crowdfunding Platforms: These platforms offer a low-risk way to attract donors who can help fund your health insurance company.

Step 4: Fulfill licensing and other business requirements.

Nearly all businesses and professionals in the insurance industry are required to get a license to legally offer their products or services. The specific licensing requirements can vary based on the location where you plan to establish your health insurance company.

If you plan to open an insurance agency, you may need to designate a “Designated Responsible Licensed Producer” (DRLP). This individual is a licensed insurance professional responsible for ensuring that your agency adheres to state laws and regulations.

In addition to obtaining insurance licenses, you may need to meet other business requirements before starting your health insurance company, such as:

General Business License:

Depending on state regulations, you might need to get a general business license to operate legally within your jurisdiction.

State Registration:

Insurance companies must register as a “resident business entity” with their state insurance commissioner’s office.

Step 5: Protect your company with the right business insurance.

One of the major advantages of securing business insurance is the financial protection it offers against unforeseen losses. As your business works towards success, you may encounter scenarios that could affect its profitability.

Errors can cause expensive lawsuits, while accidents and disasters can significantly impact your revenue. Having the business insurance policies is crucial for helping your health insurance company recover more swiftly.

Securing business insurance is an important step in reducing your company’s potential losses. However, combining insurance coverage with effective risk management practices is often the most effective strategy for safeguarding your business’s assets and finances.

Explore the various business insurance your health insurance company may require in this guide.

How do health insurance companies make money?

Health insurance companies generate revenue through various methods, such as:

1. Underwriting profit

Underwriting profit is determined by subtracting the total amount paid out in claims from the total premiums collected during the financial year.

For instance, if your health insurance company has earned $5 million in premiums over the year and paid out $2.5 million in claims, the remaining $2.5 million represents your underwriting profit.

2. Investments

Health insurance companies, particularly the larger ones, invest a significant portion of the premiums they collect in various assets to enhance their earnings.

3. Commissions

If you’re starting a health insurance agency, you can earn commissions for each policy you sell. Commission rates vary depending on the health insurance provider, ranging from 2.5% to 5% of the premiums for the first year. These rates typically decrease after the policy is renewed.

For those focusing on group policies, commissions are slightly lower, ranging from 1.5% to 3% of the total premiums. Since businesses often purchase group plans for their employees, you might earn four- or even five-figure amounts per company, depending on the size of the employee group.

4. Profit sharing

Many insurance carriers offer profit-sharing programs to their partner agencies. When these agencies meet specific revenue goals, the insurance companies provide them with a bonus based on a percentage of the written or earned premiums.

Is starting a health insurance company profitable?

According to the most recent market share report from the National Association of Insurance Commissioners (NAIC), accident and health insurance companies nationwide have accumulated a total of $1.44 trillion in premiums. This figure marks a 7% increase from $1.37 trillion the previous year and is nearly double the $745 billion recorded a decade ago.

These figures indicate that the market is experiencing significant growth, creating favourable conditions for those interested in entering the health insurance industry.

According to the NAIC’s report, nearly two-thirds of the total underwritten premiums come from the top 25 health insurance companies in the country. This suggests that, with effective management, a health insurance business has the potential to be quite profitable.

To ensure your health insurance company remains profitable, it’s crucial to stay updated on the latest industry trends. Regularly visiting our Life & Health News section can help with this. Bookmark this page for easy access to breaking news and the most recent industry updates.