The cost of automobile insurance is progressively rising, underscoring the importance of thoroughly exploring different options to discover an auto insurance provider that aligns with your requirements while remaining cost-effective.

The Best Car Insurance Companies | Top Rated Car Insurance Companies

To aid you in this endeavor, we assessed numerous insurance companies to identify the top-notch auto insurance providers. Our evaluation was centered on factors such as premium rates, the scope of coverage offerings, customer grievances, and the efficiency of their procedures for handling collision-related claims.

The Best Car Insurance Companies

-

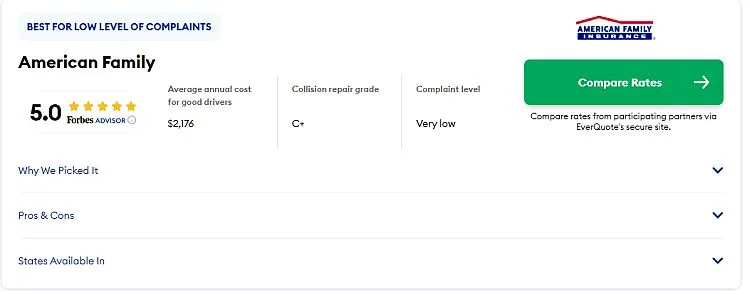

- American Family – Best for Low Level of Complaints

- Auto-Owners – Best Cost for Drivers Who Have Caused an Accident

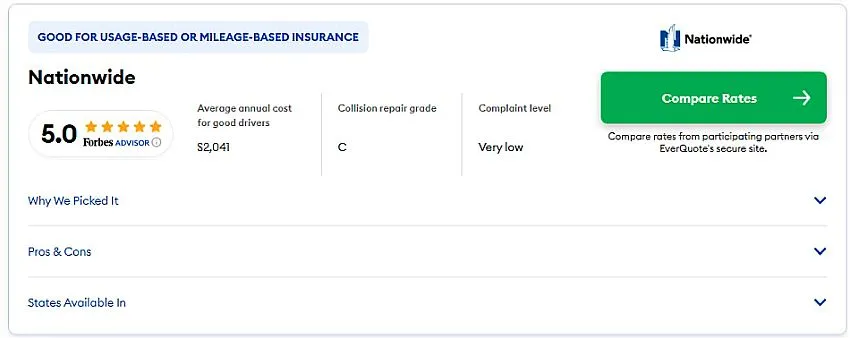

- Nationwide – Good for Usage-based or Mileage-based Insurance

- USAA – Best for Military Members & Veterans

- Geico – Best Overall Car Insurance Rates

- Travelers – Best Price for Gap Insurance

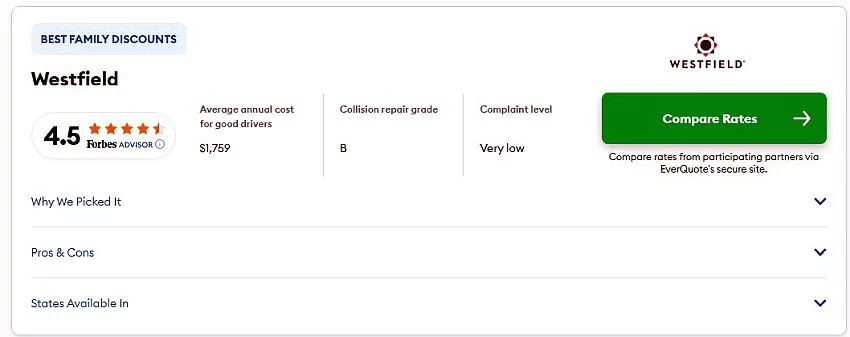

- Westfield – Best Family Discounts

- Erie – Best Grade from Collision Repair Professionals

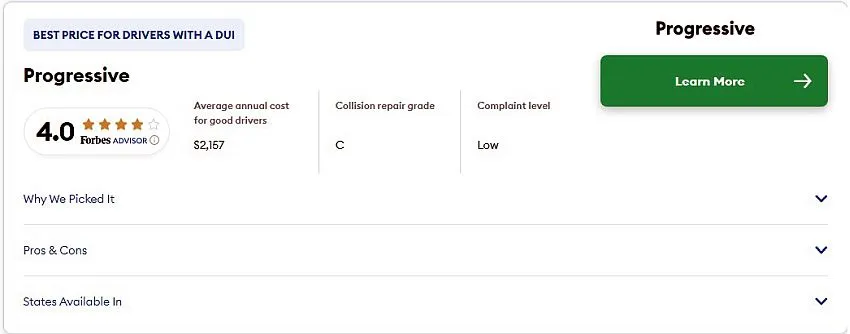

- Progressive – Best Price for Drivers With a DUI

- State Farm – Best Renewal Discount

Top Rated Car Insurance Companies

American Family

Auto-Owners

Nationwide

USAA

Geico

Travelers

Westfield

Erie Insurance

Progressive

State Farm

What Is the Best Car Insurance Company?

Based on our comprehensive assessment, it has been determined that American Family, Auto-Owners, Nationwide, and USAA stand out as the leading car insurance companies, each earning a 5-star rating in our evaluations.

USAA’s Auto Insurance Services

It’s important to note that USAA’s auto insurance services are exclusively accessible to active military personnel, veterans, and their immediate family members.

Identifying the most suitable car insurance providers for your needs hinges on factors like your driving history, location, and personal circumstances. Engaging in a diligent comparison of car insurance quotes will unveil the insurers capable of offering you the most favourable rates tailored to your situation.

Best for Low Car Insurance Rates: Geico

When examining average rates across a range of driving records and driver ages available to the general public, Geico emerges as the nationwide frontrunner with the most affordable premiums.

It’s worth noting that USAA offers even lower rates, but it’s important to remember that membership eligibility is restricted to individuals with a military affiliation.

For individuals with less-than-optimal credit scores, it’s advisable to consider obtaining quotes from Geico due to its highly competitive pricing. Acquiring these quotes proves beneficial for those with poor credit, as numerous auto insurance providers significantly raise rates based on credit history.

Best for Low Complaints: American Family and Travelers

The volume of complaints directed at a company serves as an indicator of its customer service quality. When it comes to car insurance providers, a majority of grievances pertain to claims-related issues. Notably, American Families and Travelers exhibit remarkably minimal instances of complaints in the realm of auto insurance. This assessment is grounded in verified complaints reported to state insurance departments nationwide.

Best for Collision Repair: Erie

Among the insurers we evaluated, Erie secures the top ranking according to collision repair experts, earning a notable B+ grade. These professionals possess valuable insights into which insurance companies prioritize cost-saving measures and which ones exhibit the most streamlined and efficient claims procedures.

Best for Drivers With a Speeding Ticket: Geico and Westfield

Motorists who have been issued a speeding ticket should anticipate an impact on their insurance rates lasting three to five years, contingent on the specific insurance provider and state regulations. Notably, Geico and Westfield stand out as the most affordable options for such drivers among the insurers accessible to the general public.

Geico and Westfield

It’s worth mentioning that Westfield, a regional insurance company predominantly operating in the Midwest, offers competitive rates across its coverage, available in 10 states.

USAA further extends its low-rate offerings to military personnel and veterans with speeding infractions on their driving records.

Readmore What Are Equity Loan Rates, Requirements & What It Is and How It Works

Best for Drivers Who Caused an Accident: Auto-Owners

An incident deemed “chargeable” can remain on your record, influencing your car insurance premiums for three to five years, subject to your state regulations and the policies of your chosen insurance provider.

Among the companies we evaluated, Auto-Owners emerge as the most favourable option for drivers facing this situation, offering the best average rates.

The extent of the accident’s impact, encompassing the monetary value of property damage and injuries, plays a role in determining the surcharge amount. To ascertain the duration during which this surcharge will influence your car insurance premiums, it is advisable to consult your auto insurance agent for clarification.

Best for Drivers With a DUI: Progressive

While it’s inevitable to experience elevated rates following a DUI, Progressive presents the most competitive pricing for individuals with this circumstance. This determination is grounded in nationwide averages derived from our evaluation of various insurance companies.

When obtaining a new quote or nearing policy renewal, car insurance providers typically review your motor vehicle report. This assessment allows them to modify rates following your recent record of incidents.

Notably, a DUI conviction can significantly escalate your insurance expenses, substantially affecting your coverage costs.

Best for Military Members: USAA

Continuing to offer competitive rates and an array of coverage choices, USAA maintains its position as the premier car insurance choice for military personnel, consistently earning their trust year after year. Although there has been a gradual increase in complaints related to USAA auto insurance in recent times, the current volume of grievances aligns with the industry average.

============================================

Car Insurance Rates by State

Types of Car Insurance

Liability Car Insurance

When obtaining a new quote or nearing policy renewal, car insurance providers typically review your motor vehicle report. This assessment allows them to modify rates following your recent record of incidents. A DUI conviction can significantly escalate your insurance expenses, substantially affecting your coverage costs.

If you face a lawsuit from an accident you are accountable for, liability car insurance takes care of your legal representation costs and any settlements or court rulings directed at you.

Nevertheless, this coverage is capped by your liability limits, underscoring the significance of maintaining adequate high limits. It’s crucial to note that you remain personally liable for damages surpassing your established liability limits.

Liability insurance does not provide financial compensation for personal injuries, vehicle repairs, or non-economic losses such as emotional distress, pain, and suffering.

Readmore 4 Ways to Prepare for Student Loan Repayment to restart soon as Key dates

Collision Car Insurance

Collision insurance covers the expenses for repairing damage to your vehicle, regardless of the cause of the accident. Whether you’re involved in a collision with another car or collide with an inanimate object like a pole, your collision insurance allows you to file a claim for the necessary repairs.

In the event of being hit by another driver, an alternative course of action is to file a claim with the responsible person’s liability insurance. However, vehicle owners opt for their collision insurance in some situations as it can prove more convenient than navigating the process with another party’s insurer.

Comprehensive Car Insurance

Purchasing comprehensive insurance is a wise decision as it provides essential coverage for damages to your vehicle that fall outside the scope of collision insurance. This encompasses a range of incidents like hailstorms, fallen tree branches, car fires, and damage caused by flooding.

Additionally, comprehensive insurance will also reimburse you for the value of your vehicle if it is stolen.

Typically, collision and comprehensive insurance are bundled together in a package, and purchasing them as separate, individual coverage options is impossible.

Full Coverage Car Insurance

“Full coverage car insurance” is a widely used term to describe an auto insurance policy encompassing liability, collision, and comprehensive coverage.While various other beneficial coverage options can be added to a policy, opting for full coverage car insurance establishes a solid base of protection across a diverse range of situations.

Gap Car Insurance

Gap insurance is valuable when dealing with a substantial car loan or lease agreement. In cases where your vehicle is declared a total loss or gets stolen, gap insurance steps in to bridge the gap between the insurance reimbursement for your complete car and the outstanding amount you owe on your loan or lease.

Car Loan Balance

To illustrate, if your car loan balance significantly outweighs the current market value of your vehicle, gap insurance will cover the disparity, ensuring you aren’t left with a financial shortfall.

============================================

How Much Does Car Insurance Cost?

According to an assessment conducted by Forbes Advisor, the typical annual expense for car insurance amounts to approximately $2,067. On average, this translates to a monthly payment of around $172.

Factors That Impact the Cost of Car Insurance

The expense of your car insurance is subject to variation and hinges on multiple factors, including:

- Your driving history.

- Your age and years of driving experience.

- Geographic location.

- Choices made regarding car insurance coverage.

- Chosen deductible amount, applicable if you opt for collision and comprehensive coverage.

- Vehicle make and model.

- Prior car insurance records encompass details like uninterrupted coverage or gaps.

- Your credit-based insurance score.

============================================

Auto Insurance Rates Continue to Rise

In June 2023, drivers experienced an average uptick of 1.7% in car insurance expenses compared to the previous month, as the U.S. Bureau of Labor Statistics (BLS) reported. The BLS routinely monitors the average expenditures on various goods and services, including auto insurance.

Costs 16.9%

Over a year, from June 2022 to June 2023, car insurance expenditures observed a notable surge of 16.9%. The ongoing escalation in auto insurance rates is attributed to heightened claims costs borne by insurers, which are transferred to customers through elevated rates. The increased costs of car parts, labour, and medical bills primarily drive this surge in claims prices.

How Can I Find the Best Price on Car Insurance?

Understanding the elements that influence car insurance premiums, including your credit score, can empower you to uncover potential avenues for savings. Below are straightforward methods to secure an advantageous deal on affordable car insure

Shop Around

To locate the most competitive car insurance rate, obtaining and comparing quotes from a minimum of three companies offering identical coverage levels is advisable. Given the substantial fluctuations in rates across insurers, conducting a thorough comparison is the most effective approach to maximize potential savings.

Choose a Higher Deductible

Opting for a higher deductible in your car insurance coverage is a dependable strategy for reducing your insurance costs if you have both collision and comprehensive protection. It’s important to note that liability insurance does not involve a deductible.

Ask About Discounts

To locate the most competitive car insurance rate, obtaining and comparing quotes from a minimum of three companies offering identical coverage levels is advisable. Given the substantial fluctuations in rates across insurers, conducting a thorough comparison is the most effective approach to maximize potential savings.

============================================

Do I Need Car Insurance?

Liability insurance is a legal necessity in nearly all states and remains a fundamental facet of car insurance. Its purpose is to cover injuries and property damage unintentionally caused to others in the event of an automobile accident.Uninsured motorist insurance is an additional car insurance category mandated in numerous states.

Personal Injury Protection (PIP)

Should an uninsured motorist collide with your vehicle, this coverage steps in to settle your medical expenses and those of your passengers. However, within states operating under a “no-fault” car insurance system, you would utilize your personal injury protection (PIP) to address medical costs for you and your passengers, irrespective of fault in the accident.

Car insurance, Especially for Newer Vehicles

Collision and comprehensive insurance are typically obligatory for those who have financed their vehicles through a car loan. Nevertheless, even without a car loan, it’s prudent to hold these types of car insurance, especially for newer vehicles.

Collision insurance handles accidents involving other vehicles or objects, such as buildings or poles, and pays out regardless of fault. On the other hand, comprehensive auto insurance provides coverage against car theft, fires, damages due to extreme weather conditions, floods, hailstorms, falling objects, acts of vandalism, and collisions with animals.

Methodology

To pinpoint the leading car insurance companies, we undertook a comprehensive evaluation of each entity, focusing on several key factors, including average rates for diverse driver profiles, the array of coverage options provided, the incidence of customer complaints, and the assessment from professionals in collision repair.

Auto insurance rates

Auto insurance rates (constituting 50% of the evaluation score): Our analysis drew upon data sourced from Quadrant Information Services, encompassing average rates furnished by each company across various driver categories.

These categories contain good drivers, those with accident records, individuals with speeding violations, those with DUI infractions, drivers with subpar credit, instances of driving without insurance, the addition of a teenage driver, senior drivers, and young drivers.

Unless stated otherwise, the rates were derived from the context of a 40-year-old female driver owning a Toyota RAV4, with coverage specifications including:

- $100,000 coverage for injuries to an individual, $300,000 for injuries per accident, and $100,000 for property damage (referred to as 100/300/100).

- Uninsured motorist coverage of 100/300.

- Collision and comprehensive insurance with a $500 deductible.

Car insurance coverage options (constituting 25% of the evaluation score):

While every auto insurance provider can offer the fundamental coverage essentials such as liability insurance, collision and comprehensive coverage, and other customary features, the availability of supplementary coverage options for enhanced protection or potential cost savings is equally crucial. Within this category,

we assigned merit to companies that extend offerings such as accident forgiveness, new car replacement, deductible reduction over time, usage-based or pay-per-mile insurance, and the provision of SR-22s.

Complaints Evaluation score

Complaints (representing 20% of the evaluation score): To assess this aspect, we drew upon complaint data sourced from the National Association of Insurance Commissioners.

The task of documenting and overseeing complaints against insurance companies within each state rests with the respective state’s department of insurance.

Predominantly, grievances lodged against auto insurance companies pertain to claims-related issues encompassing inadequate settlements, delays, and rejections. With the industry’s average complaint ratio standing at 1.00, companies registering a ratio below this benchmark demonstrate a lower frequency of complaints.

About Insurance Companies

Collision repair assessment (constituting 5% of the evaluation score): Our analysis integrated evaluations from experts in the collision repair field about insurance companies.

The data we employed was furnished by CRASH Network, a weekly publication covering the collision repair and auto insurance sectors. CRASH Network’s Insurer Report Card harnessed grades assigned by over 1,100 collision repair specialists to gauge the performance of auto insurers based on the caliber of their collision claims service.

Hi

Abbas khan here

Am professional logo designer